1. Static Password

The below options required to update in the cloud application BI catalog services.

Navigation: Tools → Reports and Analytics → Browse Catalog

Navigate to appropriate report template folders and Click “Edit” the Template (which needed the password protection functionality) → Click “Properties” button.

Save the changes and Run the job.

Navigation: Tools → Reports and Analytics → Browse Catalog

Navigate to appropriate report template folders and Click “Edit” the Template (which needed the password protection functionality) → Click “Properties” button.

Properties

|

Value

|

Enable PDF Security

|

True

|

Open Document Password

|

Save the changes and Run the job.

The Report output will prompt the user to enter the password when open the output.

2. Dynamic Password

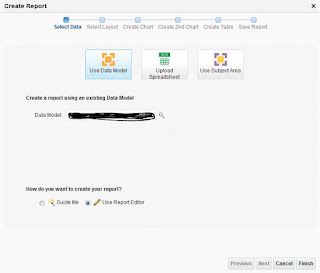

1. Create the Data Model (include/identify the field/value for password)

(ex, Supplier Number, Employee Number with DOB)

(ex)

/DATA_DS/G_1/PASSWORD (Any customized/default password group)

/DATA_DS/G_1/SEGMENT1 (Supplier Number – Default Password, for supplier related reports)

2. Define RTF Template with the Custom Properties.

Navigation: RTF Template → File → Info → Properties → Advanced Properties → Custom

Add the below mentioned two custom properties.

Properties

|

Value

|

Type

|

xdo-pdf-security

|

true

|

Text

|

xdo-pdf-open-password

|

/DATA_DS/G_1/SEGMENT1

|

Text

|

Click “OK” and Save the Template.

Upload the template to BI catalog, Run the report and check the report output.

The Report output will prompt the user to enter the password when open the output.

Documents Reference

Oracle Support Documents

1. How To Set Password Protection For BI Publisher Report (Doc ID 2117187.1)

2. How To Password Protect PDF Documents At Runtime? (Doc ID 1355332.1)

Fusion Middleware Report Designer's Guide for Oracle Business Intelligence Publisher

Setting Report Processing and Output Document Properties → PDF Security Properties

https://docs.oracle.com/middleware/12212/bip/BIPRD/GUID-300980F2-CC27-4DA5-9420-2D607CF132BF.htm#BIPRD2995